By Daniel Kivatinos

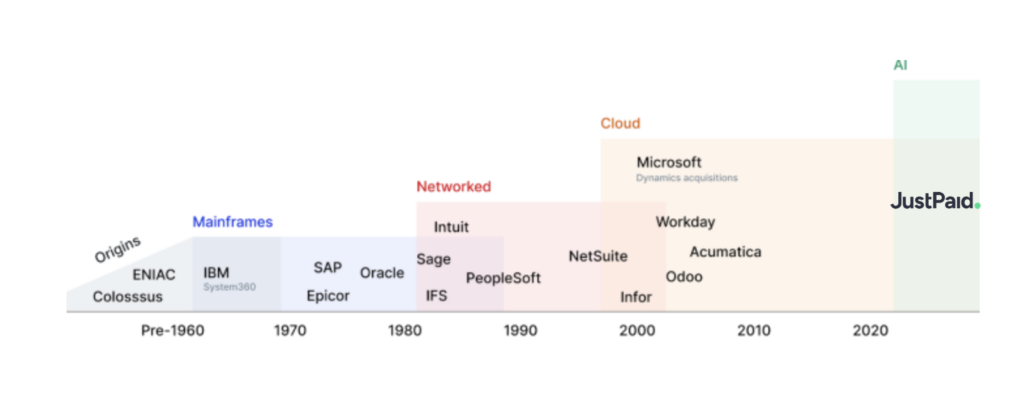

When it comes to launching a startup, timing, team dynamics, and vision are everything. As go through 2025, the AI landscape is opening up new possibilities—and new challenges. This post is a reflection on how we started building JustPaid, the lessons we’ve learned along the way, and why we believe the future of finance, accounting, accounts payable, accounts receivable needs a serious upgrade.

The Right Team at the Right Time

No great company is built alone. It takes a team.

When I started thinking about starting a new company, what matters is finding people who complement your skills, challenge your assumptions, and bring different perspectives to the table and can work on problems for years.

If everyone thinks one way like Henry Ford in a new startup, you just build another gas-powered car. Innovation needs friction—and diversity of thought, that was what I was looking for.

Serendipity and Brainstorming

The first spark came from reconnecting with Vinay, who is now my cofounder now, he was a brilliant engineer I’d worked with in the past. He had moved to Silicon Valley a few years ago, and was hungry to build something meaningful, something he could be proud of. We started meeting regularly—brainstorming ideas from AI tools for farming to software for funeral homes. Nothing stuck at first, but we kept showing up, talking and thinking.

Then, seemingly out of nowhere, I got a message from Anelya Grant. She wanted to start something too. We’d worked together years earlier, and I knew how much energy and clarity she brought to every project. During our first conversation, she laid out a vision that immediately clicked for us all. I felt real conviction—we had found a problem worth solving.

Reconnecting with Talent

Anelya had built a fractional accounting firm long before that became a buzzword. She had worked with breakout startups like TaskRabbit, Segment, Parse, DrChrono and had the grit and intuition that’s rare to find. Years earlier, we’d moved on from working together as I scaled my last company and brought in a full-time CFO. But I never forgot her passion for building things.

After selling my previous company, I knew my next move needed to be with the right people. And it turned out, they were already in my network.

Getting into Y Combinator

Once our team was aligned, we all wanted to apply to Y Combinator. I’d been through the accelerator before, and I knew what it could do for an early-stage startup—access to world-class advice, community, and credibility.

After a high-stakes interview, we got in. That moment was powerful. It validated what we felt in our gut: that there’s a massive need for smarter, automated financial workflows—especially around revenue.

The Vision: Fixing the Most Overlooked Part of Finance

Most founders don’t talk about it, but collecting revenue is brutal.

You can build the best product in the world, but if you don’t get paid, you don’t survive.

Our goal is to build an AI-powered accounts receivable agent platform, with so many layers in it, some parts being Contract AI, Payments AI, Reminders AI and Collections AI. One that helps startups automate contracts, track payments, and follow up without a human chasing every email, text or phone call.

Think of it as your tireless collections team—except it runs 24/7 and never forgets a follow-up.

The Accounting Talent Crunch

Here’s the reality: fewer people are going into accounting, even as more startups are being formed. That imbalance is creating a cost squeeze. Founders either pay top dollar for elite accounting help—or hire inexperienced talent, they try to do it all themselves and burn out.

We are here to level the playing field.

We’re democratizing access to revenue automation, so startups can stay lean and still collect what they’re owed. Small or no finance team? No problem.

Earning Trust in a Crowded Market

When you’re building something new, trust matters.

We’re lucky to have backing from Dropbox and Kleiner Perkins—two names that open doors among so many amazing investors. Their belief in our vision helps us build trust with customers.

And we’re not hiding behind the curtain. We believe in building in public, sharing our updates, and letting people see who we are and how we work. That transparency is part of the brand we’re building.

Looking Ahead: AI Isn’t the Future—It’s the Now

AI will be at the heart of how businesses run.

We’re leaning into that shift—hard. Our AI agents won’t just send reminders. It’ll talk to clients, manage contracts, and help founders stop worrying about cash flow.

Imagine closing a sales deal and knowing your AI will handle everything from invoice to collection. That’s where we’re headed.

Constraints Make Us Stronger

Every startup faces constraints—resources, time, people. But that pressure forces creativity.

Companies like Walmart thrived by embracing limits and finding efficiencies others missed.

We take the same approach. Kaizen. Continuous improvement. One foot in front of the other.

Every week, JustPaid gets a little sharper, faster, and more useful. We release updates consistently, daily and weekly.

The Road Ahead

This journey has already been full of learning, growth, and meaningful connections.

We’re not done—not even close. The mission is simple: make finance, accounting and revenue collection radically easier.

If you’re curious about what we’re building, let’s talk.

This next chapter in AI is going to change everything.

We’re ready.