The best person to start a company with is someone you have known for years. Someone who has a talent, drive and who you have seen work intensely work. Through the course of our life, there are a handful of people in your mind you think you could start a company with. I have only a few people in my mind and picked one when I started the company drchrono.

Michael was my college roommate. He had a talent for understanding complex software and could hack out just about any idea. He was doing a dual major in computer engineering and science major, and it was a breeze for him. I was a psychology and computer science major, and understood people. We took a bunch of classes together and worked well as a team, doing scrum like teamwork. As in all of our courses together. I made a mental note, he would be someone who I could work with in the future. After we both graduated Michael went on to work for Bloomberg LP and I went on to work at several startups in NYC. Several years passed when we got together to talk about working on an idea.

I recall sitting down with Michael in 2008, and we spoke about how we wanted to change healthcare over a cup of coffee. We didn’t have a business model, nor medical backgrounds, but we could build software. He was one of those people on my list I would start a company with.

After swapping personal stories about healthcare, we decided to start a company in that market. From seeing family members have a hard time working with the healthcare system we thought we could make a difference. Doctors were doing everything with fax machines, pen and paper. It was clear to us both healthcare was broken.

We really didn’t think too much about our name, jumping in with the name drchrono from day one. We picked that name as it related to time. We wanted to build something that took people and managed health over time, “dr” for doctor and “chrono” for time. There was no hard path for the company, but we had a vision for connecting doctors and patients and tracking health.

Michael quit his job of eight years to start the company with me. This was a commitment check for me to see if he was serious about doing this startup. Michael quitting his job showed to me he was serious, very serious.

We started working out of a small place called the Sunshine Suites, where we rented two desks. It was an on-demand office space with virtual offices in New York City. We then moved into an incubator space were we expanded the team.

-

-

Michael Nusimow (my cofounder)

-

-

Daniel Kivatinos (me)

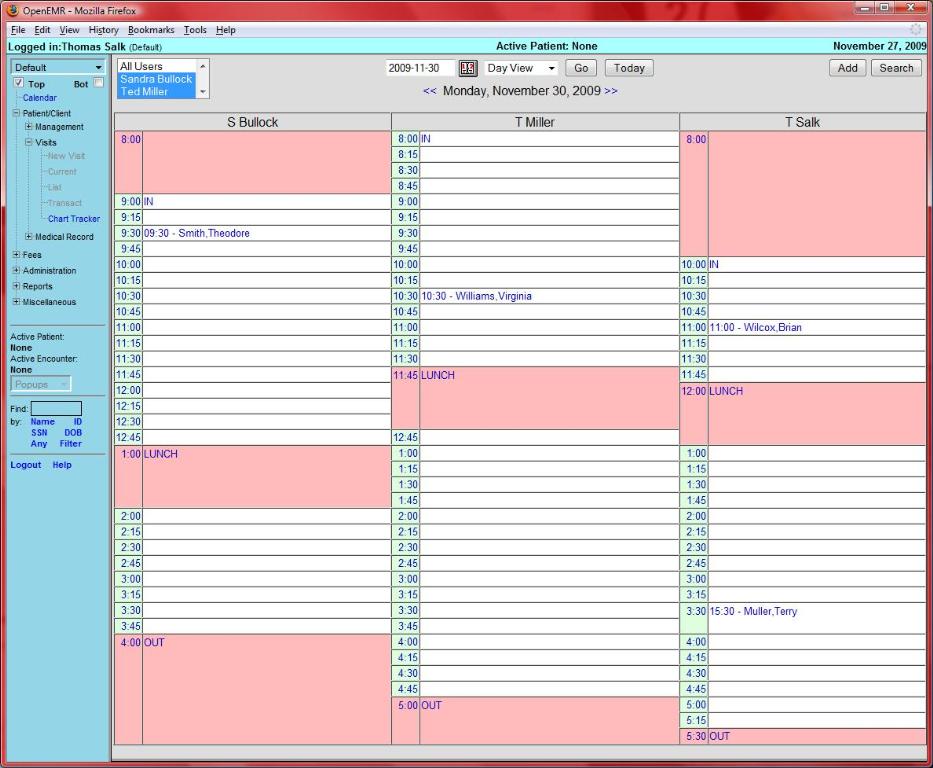

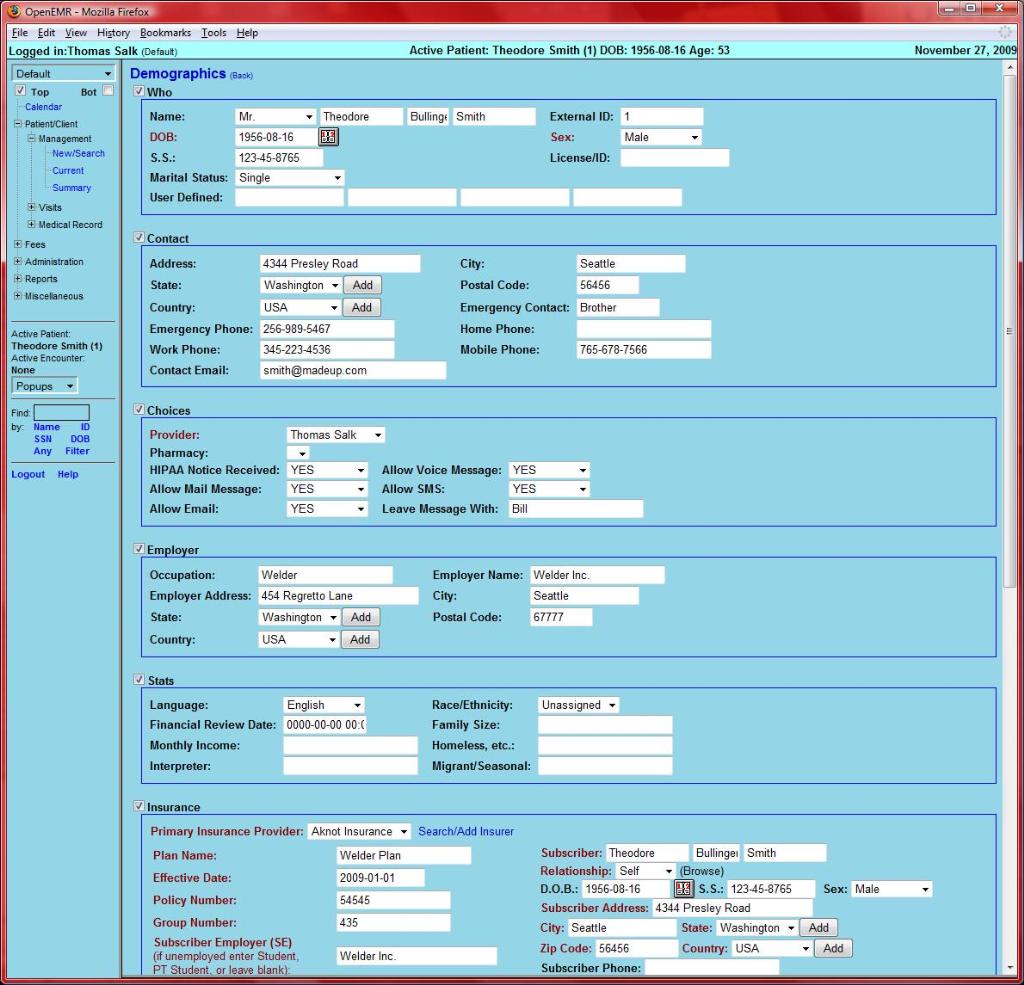

he company jumped on an unconventional band wagon of using the cloud back in 2009, most companies were just starting to think about cloud. Most medical records company during 2009 were not using the cloud, part of our vision is to run all medicine in the cloud, the data, scheduling, billing, etc. Other companies were building for the desktop or using Adobe Flex, Flash or .Net, we decided that was the wrong route and it was a mistake. So we built on the same type of infrastructure that Google was using, Python and Linux. It pays off to really look at the tech stack you use, not to jump on a tech fad band wagon, it can hurt you in the long run. There are a number of healthcare companies in the cloud that are using bad tech stacks and they just aren’t able to build fast which hurts them. Using a good technology stack is critical to having an amazing experience for your customer.

For the first year, we spoke to doctors, one by one, shadowing and listing to them, asking them what they wanted. We would rapidly iterate over the feedback and repeat. We interviewed and shadowed doctors in hospitals, in large clinics as well as private practice doctors.

Ever entrepreneur should take as much feedback as possible and work on it, but remember filtering is critical. We get feedback from all kinds of doctors and patients; we picked what makes the most sense. Some physicians would give amazing input and others would give unproductive feedback. We still shadow doctors today, and that is how we know what we are doing right and what we are doing wrong. Software is an ever evolving thing that needs care.

After working for over a year, we built out a medical platform that could do medical billing, scheduling and email reminds to patients. In April 2010 the iPad came out, and I pushed us to build an app for it, I believed mobile was the future and it is. Thousands of doctors downloaded the initial release. We were the first medical records app on the iPad. It was an inflection point. It pushed us to build the best mobile EHR in the world. Today we have the highest rated medical records app in the iTunes app store. Our goal is to create the best healthcare experience through technology and we are doing just that.

Doing a startup in healthcare is not an easy thing. I tell entrepreneurs who want to jump into the healthcare space to do a startup be ready to take at least 7+ years of your life to create something meaningful and passion is a must and find people who are as passionate as you to build the company with.

It takes years to build something meaningful in healthcare. drchrono isn’t an overnight success, it was years of hard work. Yes most startups are a long journey, but startups in healthcare are the hardest type of companies to build. Overnight successes just don’t happen in healthcare.

When Michael my cofounder and I started drchrono, no one told us that it would take years to make something meaningful, it is our passion for changing healthcare that pushes us every day. We feel like we have only started.

drchrono now has over 45,000+ thousand physicians signed up and over 2,500,000+ million patients.